I live in Rockville, Maryland, which actually has one of the better managed governments I've seen. But everyone makes mistakes.

Until recently, one of the best-kept secrets had to do with parking at the Twinbrook Metro station. In the station parking lots, run by Metro, you would pay $4.75, assuming you've traveled on the subway. Outside the Metro, on the streets, the parking meters cost 25 cents an hour through 6 p.m. If you arrived at 8 a.m. and returned after 6, it would cost you only $2.50. A lot of people didn't know about this at all, and I told only close friends of mine. (Of course, some people knew about it and nevertheless avoided the meters, because they didn't want to keep rolls of quarters in their car or go to City Hall to pick up the electronic meter card.)

Recently, the City decided it needed more revenue from the meters, and effective last week, the price doubled to 25 cents a half hour (50 cents an hour). A 10-hour parking stint now costs $5.00, which makes the Metro parking lot a better deal by a slight margin.

Since the charge went up last week, almost no one has been parking at the meters near the Metro station. It used to be that at 8:00, there were still spaces available on the next block, but the two sides of the street right across from the lot were almost always full. Now, at 8:00, there are maybe four or five cars across from the lot, instead of roughly 30.

I suspect some people will eventually return, once they get over their annoyance at the price increase. But I wonder whether Rockville city council members realized that the City's revenue was going to drop when they raised the meter rates. Economics 101 suggests that there was an intermediate figure by which they could have maximized revenue. A charge of 25 cents for 45 minutes (33.3 cents an hour) or 25 cents for 40 minutes (37.5 cents an hour) might not have driven off all those parking customers.

So basic economics continues to work in Rockville. Increased fees, just like tax increases, can cause people to alter their behavior and reduce revenue in the process.

December 08, 2008

Economics 101 has lessons for Rockville

November 06, 2008

The Obama Dow Jones Death Watch

"This was the moment when the rise of the oceans began to slow and our planet began to heal . . . and the Dow Jones Industrial Average began to plummet."

I apologize for being a little serious here, but it's Day 2 after the election and the Dow has plummeted again. Down over 10% in two days since the election. Maybe it wouldn't be such a bad idea for the man to say, "You know, we're not going to raise taxes after all, and we're going to push for a capital-gains tax cut for everyone." I mean, the election's over, and he can say whatever he wants, including things that actually make sense.

The suck-up and spin headline award goes to AFP: "Despite Obama win, Wall Street turns to hard days ahead."

This one makes more sense to me, from AP: "Stocks plunge as investors ponder Obama presidency."

And if you think I'm just being mean and vindictive, consider this: It's the worst two-day percentage drop since the crash of October 1987.

Consider what this means, too: "World markets traded lower Wednesday despite strong gains in Asia overnight as investors booked profits after Senator Barack Obama won the U.S. presidential election and the Democrats took a firmer hold on Congress." Booking profits means they're expecting the market to fall. It doesn't mean what the article suggests -- that investors were somehow doing well as a result of the election.

Biggest post-election plunge ever.

UPDATE (11/8): OK, the Dow went up 248 points yesterday, recovering just over a quarter of the two-day loss. It won't go down forever.

But Dana Milbank, one of my least favorite Posties, made this amusing point about Obama's press conference on Friday:

When Obama began his speech, the Dow Jones industrial average was up 255 points for the day.Now that the election's over and their guy won, I guess they can loosen up a little.

The AP's Nedra Pickler asked what economic measures he would take in his first 100 days. He offered boilerplate about how "my transition team is going to be monitoring very closely what happens over the course of the next several months." The Dow's gains shrank to 145 points.

ABC News's Jake Tapper asked how he would respond to a congratulatory letter from Iran's Mahmoud Ahmadinejad. "I will be reviewing the letter from President Ahmadinejad, and we will respond appropriately," Obama answered. The Dow's increase on the day had shrunk to 131 points. Only after Obama disappeared behind the curtain did the market resume its advance.

Posted by

Attila

at

9:44 PM

|

![]()

Labels:

Barack Obama,

economics,

Election 2008

November 05, 2008

Another vote: no confidence

"This was the moment when the rise of the oceans began to slow and our planet began to heal . . . and the Dow Jones Industrial Average began to plummet."

[Ed. - I know it technically didn't "begin" to plummet, but it had actually climbed 1,450 points in the previous 6 days of trading, up from 8,175 on Oct. 28.]

.

Posted by

Attila

at

6:11 PM

|

![]()

Labels:

Barack Obama,

economics,

Election 2008

September 21, 2008

The Inquiring Photographer: Who's responsible for the economic crisis?

The Inquiring Photographer asks:

"Who is responsible for the current Wall Street financial crisis?"

"The money changers at the Temple of Greed. I have overturned their tables."

Barack Obama, Illinois

"The Russians. I can see them through my telescope from Alaska, and the deed was plotted in that room right next to what's obviously Putin's bedroom, if you catch my drift."

Sarah Palin, Alaska

"Franklin Raines, who ran Fannie Mae into the ground, and a bunch of other Big Scary Black Dudes."

John McCain, Arizona

"Too busy campaigning for Obama to give you much detail, but I agree it was the BSBDs."

Hillary Clinton, New York

"It wasn't the Russians, but she can check out my bedroom any time."

Bill Clinton, Arkansas

"I have no idea at all. I'm going home."

Harry Reid, Nevada

"It was a lot of paper money, the Federal Reserve, and the Jewish bankers."

Ron Paul, Alpha Centauri

"Pat Buchanan. Buchanan is responsible for all evil in the world, except when he endorses Obama's policy toward Israel."

Robert Wexler, Florida (Not)

"I'm cool with 'the Jewish bankers.' When the man's right, he's right."

Jeremiah Wright, Flying Spittle

Previous:

The Inquiring Photographer: Where will you invade?

The Inquiring Photographer: How did you propose?

The Inquiring Photographer: What form of torture?

The Inquiring Photographer: Leaving your place of worship?

The Inquiring Photographer: Is Obama's nomination significant?

Posted by

Attila

at

7:50 PM

|

![]()

Labels:

economics,

Election 2008,

politics-general

August 03, 2008

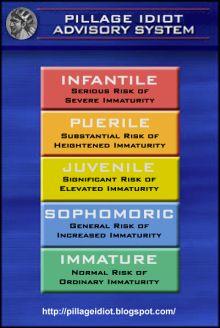

From the Pillage Idiot "Spam Period"

In Peter Schickele's hilarious biography of P.D.Q. Bach, the author divides the composer's work into three periods -- the "Initial Plunge," the "Soused Period," and "Contrition."

I thought it was the least I could do to create a period for myself called the "Spam Period," the roughly 48-hour period when Pillage Idiot was shut down by Blogger as a potential spam blog. I'm going to post some junk I was unable to post during that period. And I'd like to make it clear that I have not yet reached "contrition," if I ever do.

Kool-Aid party over at Rabbi Jack Moline's place

I'm relieved to see that nothing, nothing can shake the Jews out of their politika mi-sinai (my bastardized Hebrew approximately meaning "politics given at Mount Sinai"). According to the Washington Jewish Week, Northern Virginia Jews are mobilizing to support Obama. Isn't that special?

Rabbi Moline is actually a pretty sensible guy in general (but see), so it's even worse for him to be trying to sell undecided Jews like this:

Moline assured his listeners that Obama's record on Israel is "stellar," and that there is "nothing in the senator's record to indicate that he would make any other concessions than the current president" would make.I guess Rabbi Moline thinks Jews can't legitimately be concerned about Obama's associations with folks like Rashid Khalidi or his 20-year association with Jeremiah Wright, whom he disowned for calculating political reasons, or his association with William Ayers and Bernadine Dohrn, two domestic terrorists, whom he's never disowned, or an ever-emerging cast of characters. No, it's got to be prejudice, because what right-thinking Jewish person could not want to place hope in someone like him? Did the Children of Israel doubt Moses himself? And when the Torah said (Deut. 34:10), v'lo kam navi od b'yisrael k'moshe, could it possibly have meant to exclude Obama?

Questions about Obama's support for Israel are a cover, Moline said, for underlying prejudice.

"We have to own up to the prejudice in our own community. There are plenty of people who say they're ambivalent about him because he's black, he has a middle name that sounds like the deposed president of Iraq, that he's the son of a single mother," Moline told the gathering. "Those prejudices in our community generally don't get spoken. They get expressed in questions about Israel."

In all seriousness, I'm sure that when Obama says he supports Israel, he's as sincere as he is about anything. But really, why should Jews who are concerned about Israel not have the right to doubt a guy who wants to scale back American power? Without American power, Israel is doomed, no matter what nice things a political candidate says.

But it sure is easy to dismiss the concerns that some Jews have about him as purely based on prejudice. Thanks a bunch, Rabbi Moline.

Economics 101 -- tax policy

I thought everyone knew that when you cut taxes your revenue dropped and vice versa, so that when you doubled taxes, your revenue would double. It's called "static revenue analysis."

Apparently not.

The Washington Post reports: "Cigarette sales have dropped by nearly 25 percent in Maryland since the state's tobacco tax doubled in January, as sticker shock apparently has curtailed some residents' smoking and sent others across the border for better deals."

And of course, the folks who think government exists to change human behavior often have a totalitarian mentality -- when people react rationally to your policies, you try to squash them:

Maryland law seeks to limit out-of-state cigarette purchases. It is illegal for Maryland residents to be in possession of more than two packs of cigarettes lacking stamps showing that taxes were paid in the state.So this is the way it works: Try to increase revenue by raising cigarette taxes. People reduce smoking or shop elsewhere. Tax revenues go down. So you call these smokers smugglers and threaten prosecution. Brilliant.

We're not crashing into people's homes to see if they've purchased a pack or two more than they should out of the state, but we have a very aggressive effort concentrated on larger smugglers," said Joseph Shapiro, a spokesman for the Maryland Comptroller's Office.

Miscellaneous

Pillage Idiot appears 4,000 years ago in Sumer: "Flatulence joke is world's oldest"

Say what you want about the President, but he's a really decent guy: The Party Crasher

Posted by

Attila

at

1:51 PM

|

![]()

Labels:

Barack Obama,

economics,

Election 2008,

flatulence,

George Bush,

Israel,

Jews,

Maryland,

tax

July 30, 2008

Another day, another environmentalist rabbi

I'm not going to say much about this Torah commentary from the Jewish Theological Seminary (Conservative Judaism's rabbinical academy), because it's really a self-parody. The commentary was written by Rabbi Abigail Treu, described as the director of Donor Relations and Planned Giving for the Sem. That is, she's a fundraiser, but a rabbi at the same time.

To give you the flavor of the commentary, in case you don't want to click on the link, here's the opening paragraph:

Golda Meir famously quipped: “Let me tell you the one thing I have against Moses. He took us forty years into the desert in order to bring us to the one place in the Middle East that has no oil!” Well, the folks living atop the Marcellus Shale have the opposite gripe. Underneath this formation, which stretches from the Catskill Mountains in upstate New York through Pennsylvania and Ohio to Virginia, there is oil. And with the price of oil being what it is, the oil companies have new incentive to drill there and have come calling. Which presents the farmers and landowners in this four-state stretch with a dilemma: what is more important, the beauty and health of their land or their economic security?I know! Call on me! The farmers should preserve the beauty of their land, despite their relative poverty, so that rich liberals can enjoy the natural beauty.

Oy, vey! Rabbi Treu's commentary goes on to discuss what she sees as environmentalism in this week's Torah portion, culminating in her tribute to the idealism of Jewish law (about which see my discussion of the prosbul).

Most of us curmudgeons are strong believers in conservation, but that's not what we're talking about here. In case you were still doubting that the great project of environmentalism is to destroy the economy and reduce our standard of living, consider the way Rabbi Treu closes her commentary. We should learn, she says, from the mistakes of the Children of Israel in the wilderness, adding:

We too are poised on a threshold, contemplating how to react to our own scary reports of an uncertain future. We would do well to take the mantle of tikkun ‘olam onto our own shoulders, so that our children may be blessed to recite one hundred blessings a day, and live in a world in which the lack of oil is a source of celebration, not regret.What's really scary is that the head of fundraising for the Sem is so clueless about why donors have money in the first place: They have money because they engage in commerce. Of course, if she had her way, there would far less commerce. I wonder whether she would then declare that the ensuing drop in donations to the Sem was a source of celebration, not regret.

Posted by

Attila

at

9:36 PM

|

![]()

Labels:

Conservative Judaism,

economics,

left-wing Jews,

Torah

July 29, 2008

Tuesday evening linkfest

Here are a few links I've been collecting:

1. You know you're having a bad day at the gym when the exercise machine shoots you out like a slingshot.

2. I had a visitor looking for information about flatulence in Beethoven's Second Symphony. (It's not as strange as it sounds; listen to the fourth movement.) So I followed his search link and discovered that it's really the choral movement of the Ninth that's flatulent. So says an op-ed in the NY Times from last December. I'm serious. Check it out.

3. In light of that, scientists have strapped plastic bags to Beethoven's back to measure the effect of his flatulence on global warming. Sorry, it's Argentinian cows who have to suffer this indignity. Photo at link. (Hat tip: fee simple)

4. The headline says it all: "Gummy Bears That Fight Plaque" (via HotAir)

5. The Snickers ad: How to be retro and edgy at the same time.

6. As a follow-up to my post from last September on the same subject and the same "scientist," I'm giving you this article on "breast biomechanics." (via Ace)

7. The Maryland Death Penalty Abolition Dog And Pony Show (MDPADAPS) is now underway. I'm on the edge of my seat wondering what the commission's conclusion will be.

8. Soccer Dad deals with Obamoid stupidity so you don't have to. Or is "stupidity" the new "uppity"?

9. If the carnivores can do it, so can the vegetarians. A veggie "hot dog" eating contest, I mean. Except for the fact that Tofurky sucks major eggs. And don't neglect to click to read the waiver required of participants. (On The Red Line)

10. Mark Newgent takes on more left-wing economic idiocy. (See here for my own post from last week.)

11. Mightily pissed off (and more dubious language) because an editor removed the indefinite article formerly the penultimate word in his column. (via Three Sources)

Posted by

Attila

at

9:28 PM

|

![]()

Labels:

Barack Obama,

breasts,

death penalty,

economics,

Election 2008,

exercise,

flatulence,

food,

language,

vegetarians

July 22, 2008

Harvard misunderstands America

My father used to say that you had to be really smart to be really stupid. This article about a bunch of Harvard professors would have confirmed him in that wisdom.

The thrust of the article is that there is a wide and growing gap in income in the United States between rich and poor. This is what keeps professors at the nation's richest university awake at night.

Disparities in health tend to fall along income lines everywhere: the poor generally get sicker and die sooner than the rich. But in the United States, the gap between the rich and the poor is far wider than in most other developed democracies, and it is getting wider. That is true both before and after taxes: the United States also does less than most other rich democracies to redistribute income from the rich to the poor.There we go: redistribution of income. I guess it's time for poorer universities to start grabbing some of Harvard's endowment.

Our failure to redistribute income adequately is a huge problem, according to the folks at Harvard:

The level of inequality we allow represents our answer to “a very important question,” says Nancy Krieger, professor of society, human development, and health at HSPH: “What kind of society do we want to live in?”Obviously, a society that rewards economic risk-taking and hard work with confiscatory taxes. Far better than what Professor Lawrence Katz fears we're creating -- "something like a caste society." That must be why so many Indian engineers have moved here.

But what kind of inequality do we really have in this country if there is so little true poverty? It turns out that it's not so much actual poverty that's important but "relative deprivation."

The idea is that, even when we have enough money to cover basic needs, it may harm us psychologically to see that other people have more. When British economist Peter Townsend developed his relative deprivation index in 1979, the concept was not new. Seneca wrote that to be poor in the midst of riches is the worst of poverties; Karl Marx wrote, “A house may be large or small; as long as the neighboring houses are likewise small, it satisfies all social requirement for a residence. But let there arise next to the little house a palace, and the little house shrinks to a hut.”Ah, yes, Karl Marx. That worked out well, didn't it?

As most non-academics understand, the United States is both the most prosperous country in the world and the one with the smallest amount of serious poverty -- certainly when you consider countries with large populations. The explanation is also pretty obvious outside of academia: We have a generally capitalistic economic system; we have an economic and social system that encourages entrepreneurialism; we have a relatively low level of discrimination in the economic realm; and we have a general attitude (again, outside of academia) that people can reach for the stars. We have some redistribution of income, but we don't see government solutions to every problem. Americans are notoriously generous with their own money. ("The United States is 'a land of charity,' says Arthur Brooks, an expert on philanthropy and a professor at Syracuse University's Maxwell School, who sees charitable giving and volunteerism as the signal characteristic of Americans.")

The Harvard professors don't seem to get it. The article cites "Americans’ unique attitudes toward inequality," but it immediately proceeds to caricature those attitudes:

It makes intuitive sense that those who view poverty as a personal failing don’t feel compelled to redistribute money from the rich to the poor. Indeed, Ropes professor of political economy Alberto Alesina and Glimp professor of economics Edward L. Glaeser find a strong link between beliefs and tax policy: they find that a 10-percent increase in the share of the population that believes luck determines income is associated with a 3.5-percent increase in the share of GDP a given nation’s government spends on redistribution (see “Down and Out in Paris and Boston,” January-February 2005, page 14).These professors also caricature Americans as racist: "Those U.S. states with the largest black populations have the least generous welfare systems." Another professor agrees:

And in a nationwide study of people’s preferences for redistribution, Erzo F.P. Luttmer, associate professor of public policy at the Harvard Kennedy School (HKS), found strong evidence for racial loyalty: people who lived near poor people of the same race were likely to support redistribution, and people who lived near poor people of a different race were less likely to do so. Differences in skin color seem to encourage the wealthy to view the poor as fundamentally different, serving as a visual cue against thinking, “There but for the grace of God go I.”But my personal favorite caricature is this one:

The Constitution is structured in such a way that it is harder to change than the constitutions of Europe’s welfare states, where left-leaning groups have succeeded at writing in change. By and large, Alesina and Glaeser write, the U.S. Constitution “is still the same document approved by a minority of wealthy white men in 1776.”In case you missed their point, let me explain: The Constitution protects property and is difficult to amend. This was done because the Constitution was written by a minority (in the bad sense of the term) of "wealthy white men" who favored their own interests over those of non-wealthy white men, as well as wealthy white women, and wealthy non-white men, all of whom were too busy watching reruns of 18th-century sitcoms to rise up against the protection of private property. What's worse, this system unfortunately prevents "left-leaning groups" from solving poverty through redistributive schemes.

So why haven't Americans risen up against this staggering inequality? First, apparently, non-rich Americans suffer from false consciousness: "The prospect of upward mobility forms the very bedrock of the American dream." Unfortunately, says the article, this bedrock is based on quicksand.

In fact, a recent Brookings Institution report cites findings that intergenerational mobility is actually significantly higher in Norway, Finland, and Denmark—low-inequality countries where birth should be destiny if inequality, as some argue, fuels mobility.This is really the wrong question, though. The right question is whether individuals themselves remain in the same quintiles through their working careers. That is, is there economic mobility in the United States? The answer is that there is substantial mobility, as the data in this analysis show. Pay attention, in particular, to the discussion of mobility out of the bottom two quintiles and the information on these charts from pages 17 and 18:

In the United States, the correlation between parents’ income and children’s income is higher than chance: 42 percent of children born to parents in the bottom income quintile were still in the bottom quintile as adults, and 39 percent of children born to parents in the top quintile remained in the top quintile as adults, according to the Brookings analysis.

The second reason the article offers for Americans' failure to rebel is that the political deck is unfairly stacked against the poor. Sure, we no longer have property ownership as a qualification for the vote. Sure, everyone's vote is equal, regardless of income. Sure, there are a lot more non-rich than rich. But money's still a big factor in politics.

The second reason the article offers for Americans' failure to rebel is that the political deck is unfairly stacked against the poor. Sure, we no longer have property ownership as a qualification for the vote. Sure, everyone's vote is equal, regardless of income. Sure, there are a lot more non-rich than rich. But money's still a big factor in politics. More than half of households make less money than average, so, broadly speaking, more than half of voters should favor policies that redistribute income from the top down. Instead, though, nations—and individual states—with high inequality levels tend to favor policies that allow the affluent to hang onto their money.You might think that some below-average-income voters would accept that everyone is entitled to his own money and not demand redistribution. But let's indulge the Harvard academics their assumptions. The theory is this:

Filipe R. Campante, an assistant professor of public policy at HKS and a former student of Alesina’s, thinks he’s discovered why. After investigating what drives candidates’ platforms and policy decisions, Campante has concluded that donations are at least as influential a mode of political participation as votes are.

Candidates, naturally, target voters with money because they need funds for their campaigns. And since the poor gravitate toward parties that favor redistribution and the wealthy align themselves with parties that do not, campaign contributions end up benefiting primarily parties and candidates whose platforms do not include redistribution. By the time the election comes around, the only candidates left in the race are those who’ve shaped their platforms to maximize fundraising; poor voters, says Campante, have already been left out.I think my father would have been shaking his head and grumbling at this explanation. The wealthy in the current electoral cycle are actually favoring the Democrats, whose pitch is far more redistributionist than the Republicans'.

In any event, Campante's explanation makes little sense. Both of the major political parties are awash in campaign contributions, so how can it be that "campaign contributions end up benefiting primarily parties and candidates whose platforms do not include redistribution"? Is Campante saying that the poor are harmed because no one's contributing to socialist third parties?

I have a radical suggestion that might actually explain things: Americans, by and large, think the system is fair. They like a system that lets poor people get rich and rich people become poor. They like the freedom. They know the system is imperfect, but they also doubt that the government knows better who deserves to keep his money and who deserves to have it taken from him.

Maybe I'm way too optimistic about this, but I think I have a stronger sense of reality than the Harvard professors interviewed in that article.

Posted by

Attila

at

10:08 PM

|

![]()

Labels:

economics,

Ivy League

June 29, 2008

The use and misuse of Tikkun Olam

My old quip: "When I hear the words 'tikkun olam,' I reach for my wallet."

"Tikkun olam" is the Jewish concept of repairing or perfecting the world. It's been misappropriated by the Jewish left as a justification for trying to impose certain left-wing doctrine and policies on the rest of the world. (Hence, the reason for concern about theft of my wallet.)

In the new issue of Commentary magazine, July-August 2008, Hillel Halkin writes an extremely important article about this phenomenon: "How Not to Repair the World." Commentary usually makes its content available while it's current, but the magazine just came out and this is not yet available online. If you've been around Pillage Idiot long enough to read my rare serious posts, you'll realize I tend to understate things. But I don't want to understate this. The Halkin article is important enough for you to go out and buy the dead-tree version of the magazine, or at least, to go read it in the public library. Assuming a link becomes available, I'll update this post with it. [UPDATE: Sorry to report that Commentary is making only an abstract available, a short part of the opening of the article. UPDATE: Soccer Dad points out that many libraries have online access to Commentary if you have a library card.]

Halkin takes off from a collection of essays by Jewish leftists, many of whom invoke tikkun olam in support of their goals. But Halkin explains that there are several concepts of tikkun olam in Jewish thought, none of which supports the leftists' version. First, there's a religious, messianic version in the aleinu prayer, which is recited near the end of the morning, afternoon, and evening prayers. We pray that eventually, all the people of the world will recognize God's will. "We hope for the day when the world will be perfected under the Kingdom of the Almighty."

The second version of tikkun olam is a more pragmatic version found in the Talmud, a version Halkin describes as equivalent to the Jewish public interest. An example of it is the talmudic rule that if you are ransoming a kidnapped hostage, you must not, for reasons of tikkun olam, pay an excessive ransom. If you pay an excessive ransom, you'll "jack up the price" that others must pay to ransom their hostages. The public interest overrides your own.

Yet a third version is a spiritual one that was offered by the kabbalists of the 16th century. The idea was that the world was fractured at creation, and that individuals, through prayer and other spiritual activities, can help to repair it. As Halkin explains, this concept of tikkun olam is appealing to the political left, because it is open to reinterpretation.

Halkin then analyzes the essays I mentioned above, which he says are easy to caricature, because many of them caricature themselves. "They represent the ultimate in that self-indulgent approach, so common in non-Orthodox Jewish circles in the United States today, that treats Jewish tradition not as a body of teachings to be learned from but as one needing to be taught what it is about by those who know better than it does what it should be about."

There is much, much more of interest in this article, but I want to close the way Halkin closes, with a discussion of the prosbul, a subject I've ruminated about often and even written about myself. The prosbul (Halkin spells it "pruzbul") was a pronouncement from the great rabbi Hillel that created a huge loophole in the Torah's law of remission of debts. Halkin quotes a source I'd been unaware of, and he puts the entire issue into perfect clarity for me.

The Torah (Deuteronomy) states that in the sabbatical year, all debts will be cancelled. The sabbatical year is earth-centered, not loan-centered, so this doesn't mean you can always have six-year loans. If you lend in the sixth year of the cycle, the loan is cancelled the following year. The Torah itself recognizes that this is an idealistic law and contrary to rational economics. Deuteronomy 15:9-10 states:

Beware lest you harbor the base thought, "The seventh year, the year of remission, is approaching," so that you are mean to your needy kinsman and give him nothing. He will cry out to the Lord against you, and you will incur guilt. Give to him readily and have no regrets when you do so, for in return the Lord your God will bless you in all your efforts and in all your undertakings.In an attempt to make this law cancelling debts work, God Himself issues a threat (you will incur guilt) and makes a promise (He will bless you) in order to motivate people to overcome their natural and rational economic behavior. But even when God speaks, the law doesn't work. People don't want to lend money in the sixth year.

So the law, which was clearly designed to protect the poor from incurring permanent debt, had the unintended result of hurting the poor by totally drying up credit as the sabbatical year approached. (You don't have to have a vivid imagination to note the parallel with modern social legislation.) Hillel's prosbul allowed the loan to be assigned to the court so that it could be enforced past the end of the sixth year, in spite of the remission of debts in the seventh year.

What I didn't realize until reading Halkin's article was that the Talmud described Hillel's prosbul as having been enacted "for the sake of tikkun olam." Imagine that: The great idealistic legislation of the Torah, which was supposed to benefit the poor, was changed (or, I suppose, more accurately, was "loopholed" out of existence) by a pragmatic rule that seemed to favor the wealthy but actually helped the poor. And the justification for that change was tikkun olam, in the pragmatic sense of the Jewish public interest.

It is critical to keep this in mind whenever we hear the modern Jewish left invoking tikkun olam.

Posted by

Attila

at

3:06 PM

|

![]()

Labels:

economics,

Jews,

left-wing Jews,

Torah

March 14, 2008

Another environmentalist plans to destroy the economy

Ho-hum. Another day, another Ivy League dean with plans to destroy the economy.

James Gustave Speth, Dean of the Yale School of Forestry & Environmental Studies, explains why we need to control human activities to protect the environment. By doing what? Well, here's a hint: The title of his article is "The problem with capitalism."

Typically, when we're warned of a major environmental catastrophe, we aren't told how much it will cost to avoid. How many prophets of catastrophic climate change will divulge the economic and human costs to be incurred in what they see as an effective response? Pretty much no one does. Either the subject has never crossed their minds, or the costs will be so astronomical and the disruption to the lives we're used to leading will be so profound that it would detract from their prophecy.

So I give Dean Speth some credit for letting the cat out of the bag.

It turns out, he says, that capitalism works too well: "The capitalist operating system, whatever its shortcomings, is very good at generating growth."

Because even the poor are destroying the Earth.

Most basically, we know that environmental deterioration is driven by the economic activity of human beings. About half of today's world population lives in abject poverty or close to it, with per capita incomes of less than $2 per day. The struggle of the poor to survive creates a range of environmental impacts where the poor themselves are often the primary victims -- for example, the deterioration of arid and semi-arid lands due to the press of increasing numbers of people who have no other option.But if the poor are not blameless, it's the rich who really are destroying the Earth.

But the much larger and more threatening impacts stem from the economic activity of those of us participating in the modern, increasingly prosperous world economy. This activity is consuming vast quantities of resources from the environment and returning to the environment vast quantities of waste products. The damages are already huge and are on a path to be ruinous in the future.And what's to blame? Well, you know the answer already: Capitalism.

These features of capitalism, as they are constituted today, work together to produce an economic and political reality that is highly destructive of the environment. An unquestioning society-wide commitment to economic growth at almost any cost; enormous investment in technologies designed with little regard for the environment; powerful corporate interests whose overriding objective is to grow by generating profit, including profit from avoiding the environmental costs they create; markets that systematically fail to recognize environmental costs unless corrected by government; government that is subservient to corporate interests and the growth imperative; rampant consumerism spurred by a worshipping of novelty and by sophisticated advertising; economic activity so large in scale that its impacts alter the fundamental biophysical operations of the planet -- all combine to deliver an ever-growing world economy that is undermining the ability of the planet to sustain life.Got that? We improve our lives but harm the environment. Better medicine and longer lives? Bad. Better hygiene and better health? Bad. Greater comfort? Bad. Increased ability to produce useful goods? Bad.

The solution for Dean Speth can be summed up in one phrase: "long-term solutions must seek transformative change in the key features of this contemporary capitalism."

This is the final line of his article, so we are left to wonder what changes he has in mind. Central control? Probably. Population reduction? Probably. And the result we can surely predict. Less innovation, less research and development of medicines and medical treatments, a stunted economy.

But the Earth will (by assumption) be happier. Which is far more important, anyway, isn't it?

Posted by

Attila

at

7:31 AM

|

![]()

Labels:

economics,

Ivy League

February 06, 2008

Exxon undertaxed?

Paging John Edwards!

What do you mean, he's taking a well earned vacation?

Let's all beat up on major greedy corporations, because their profits are astronomical. And while we're at it, let's complain that ExxonMobil paid roughly $27 billion in taxes in 2004. That's billion with a capital B.

This is fascinating, actually:

Over the last three years, Exxon Mobil has paid an average of $27 billion annually in taxes. That's $27,000,000,000 per year, a number so large it's hard to comprehend. Here's one way to put Exxon's taxes into perspective.(via Instapundit)

According to IRS data for 2004, the most recent year available:

Total number of tax returns: 130 million

Number of Tax Returns for the Bottom 50%: 65 million

Adjusted Gross Income for the Bottom 50%: $922 billion

Total Income Tax Paid by the Bottom 50%: $27.4 billion

Conclusion: In other words, just one corporation (Exxon Mobil) pays as much in taxes ($27 billion) annually as the entire bottom 50% of individual taxpayers, which is 65,000,000 people! Further, the tax rate for the bottom 50% is only 3% of adjusted gross income ($27.4 billion / $922 billion), and the tax rate for Exxon was 41% in 2006 ($67.4 billion in taxable income, $27.9 billion in taxes).

January 21, 2008

Unintended consequences

The Freakonomics guys, Stephen Dubner and Steven Levitt, take a look at well intended laws with unintended consequences. As if it is somehow an insight that such laws exist. We all know that laws can encourage behavior that is undesired and, in most cases, unexpected. It happens all the time.

One of the most famous examples (which is not in the article) is the Aid to Dependent Children program: "During the New Deal, President Roosevelt's Secretary of Labor, Frances Perkins, argued against extending federal benefits to unwed mothers because she believed that subsidizing illegitimacy would lead to the breakdown of the family. Ms. Perkins was right."

Of course, people don't want to look back and see how they screwed things up. Instead, they look ahead without self-recrimination. Every mistake just creates a new need for further intervention. As I sometimes joke, being a liberal means never having to say you're sorry. But that's not my point here.

My point is that the Freakonomics article discusses three laws that had unintended results: the Americans with Disabilities Act, the Endangered Species Act -- and the rules about the sabbatical (shmita) year in the Torah. They do this to show how long this problem has existed, but, in my view, they don't quite get to the correct conclusion.

The rules in the Torah are quite relevant now, because it's generally accepted that this year is the sabbatical year. As the article notes:

As commanded in the Bible, all Jewish-owned lands in Israel were to lie fallow every seventh year, with the needy allowed to gather whatever food continued to grow. Even more significant, all loans were to be forgiven in the sabbatical.Naturally, the result of mandated loan-forgiveness is that people won't lend as the sabbatical year approaches. And the Torah makes clear that this is what happened. So the Freakonomics guys shouldn't, strictly speaking, include this within the rubric of unintended consequences, because while the consequences were unintended, the law clearly anticipated them from the outset.

Deuteronomy explicitly recognized that people would be inclined to refuse to lend money as the sabbatical year approached, because they wanted to avoid the remission of debt. If they lent in year six, whatever wasn't repaid by the end of the sixth year was, by force of law, forgiven.

Thus, Deuteronomy 15:9-10 states:

Beware lest you harbor the base thought, "The seventh year, the year of remission, is approaching," so that you are mean to your needy kinsman and give him nothing. He will cry out to the Lord against you, and you will incur guilt. Give to him readily and have no regrets when you do so, for in return the Lord your God will bless you in all your efforts and in all your undertakings.Here, God asserts a threat (you will incur guilt) and a promise (He will bless you) in order to motivate people to overcome their natural and rational economic behavior. I call this a literal deus ex machina. This kind of economic law can't possibly work unless God commands the law and people believe in Him.

And it actually didn't work even when everyone believed in God; people still would stop lending as the seventh year approached. As the Freakonomics guys point out, it took the great rabbi Hillel to devise the solution:

His solution, known as prosbul, allowed a lender to go to court and pre-emptively declare that a specific loan would not be subject to sabbatical debt relief, transferring the debt to the court itself and thereby empowering it to collect the loan. This left the law technically intact but allowed for lenders to once again make credit available to the poor without taking on unwarranted risk for themselves.It was the prosbul that encouraged people to engage in economic behavior that the idealistic rules of the Torah discouraged.

A similar legal fiction was established to deal with the rules requiring land to remain fallow during the sabbatical year. This legal fiction of temporary sale of the land to a non-Jew, by the way, is the cause of much consternation in Israel today, with many of the religiously right-wing orthodox declaring that food grown on land that has been temporarily sold should not be eaten. (Far be it from me to be critical, but anyone who uses a "shabbos clock" shouldn't be so concerned about legal fictions. But that is not my point here, either.)

We see something different, but analogous, in the of another economic law of the Torah, the prohibition of charging interest to fellow Jews. In Leviticus:

Do not lend him your money at advance interest, or give him your food at accrued interest. I the Lord am your God, who brought you out of the land of Egypt, to give you the land of Canaan, to be your God.As moderns, we have to ask: How could people have lent money for an extended period of time without interest? Again, the answer seems to be that they did so, because God commanded them to. "I the Lord am your God, who brought you out of the land of Egypt, to give you the land of Canaan, to be your God."

There's a very interesting passage from Paul Johnson's wonderful book, A History of the Jews. Johnson, a Christian philo-semite, offers Jewish history from an interesting perspective, given that nearly all Jewish history has been written by Jews. What Johnson says is this:

One of the greatest contributions the Jews made to human progress was to force European culture to come to terms with money and its power. Human societies have always shown an extraordinary unwillingness to demystify money and see it for what it is – a commodity like any other, whose value is relative. * * * Men bred cattle with honour; they sowed grain and reaped it worthily. But if they made money work for them they were parasites and lived on "unearned increment," as it came to be termed.So the Jews eventually understood that prohibiting interest couldn't possibly work as an economic matter and "force[d] European culture to come to terms with money and its power."

The Jews were initially as much victims of this fallacy as anyone else. Indeed, they invented it.

My point, finally, is that the economic laws of the Torah and the legal fictions that have been developed to get around those laws are proof that idealistic economic laws having no relationship to real economic behavior have severe limitations. They don't even work when God commands them.

As the rabbis might say, how much more so do they fail to work when imposed by humans.

October 07, 2007

Sunday linkfest

Man, I've got a whole bunch of links burning a hole in my pocket, and I just don't feel like writing an entire post about any of 'em. So here's my linkfest. Hope you enjoy these.

1. A "Mom Job"? Oy. You'll be pleased to know that even mothers of college-aged children are having this plastic surgery. "'I had been thin all my life until I had my son and then I got this pooch of overhanging fat on my abdomen that you can’t get rid of,' Ms. Birkland, 39, said. 'And your breasts become deflated sacks.'" Mind you, this is a woman with a 20-year-old son. She was about 19 when he was born, and now she's concerned with her looks -- and blaming him? I shouldn't be surprised about her. Get this line: "There is more pressure on mothers today to look young and sexy than on previous generations, she added. 'I don’t think it was an issue for my mother; your husband loved you no matter what,' said Ms. Birkland, who recently remarried." Personal to Ms. Birkland's new husband: If that's what she thinks, ditch her now; she'll only get "worse" looking.

2. An observatory on the roof of your house? Cool. "'The reason why people don’t use their telescopes is they are such a pain to haul out and set up,' said John Spack, 50, a certified public accountant who had a domed observatory built on top of an addition to his house in Chicago last year. 'Now, if I want to get up at 3 a.m. and look at something, I just open the shutter.'"

3. "Pro-semites" on JDate? When, some years ago, Irving Kristol said, "the danger facing American Jews today is not that Christians want to persecute them but that Christians want to marry them," he was right on the money. It turns out that something like 11% of members of JDate aren't Jewish but are interested in meeting Jews. Pollster Mark Penn writes in a new book "that 'the number one reason they [people he calls "pro-Semites"] gave for desiring a Jewish spouse was a sense of strong values, with nearly a third also admitting they were drawn to money, looks or a sense that Jews "treat their spouses better."'"

4. Vegans dating regular vegetarians. As a former "vegetarian" who actually ate dairy, eggs, and even fish, and the father of a former vegan who was actually serious about it until he had a revelation (that vegans are morons, or something like that) and is now a proud carnivore, I have to admit this line tickled me: "'I'm in a relationship with a murderer,' bemoans Carl, one of many vegans who wrote in to the 'Vegan Freak' podcast for romantic advice." My son was never like that when he was a vegan.

5. Speaking of vegetarians, if you work for Countrywide and you didn't get the memo, W.C. Varones got it for you. Heh!

6. Stupid pickup lines. I did like the final one, which is charmingly cheesy: "Well, here I am. What are your other two wishes?"

7. "There are signs that the global Islamic jihad movement is splitting apart." Discuss. (via protein wisdom)

8. WTF? I saw this bumper sticker on a car on the highway in Maryland: "God Bless The Whole World / No Exceptions." Yeah, I understand it now: God bless Johnny, and God bless Billy, and God bless Osama. Because, heck, we're no better than any of those guys who are trying to murder us.

9. Here's a concert I'm glad I missed: Beethoven's 9th, redone according to the "aural graffiti" that Gustav Mahler wrote on the score. Tim Page lays the smackdown on Leonard Slatkin: "Somebody should sit Leonard Slatkin down and explain to him, firmly but not without compassion, that Ludwig van Beethoven actually knew what he was doing when he composed his Symphony No. 9 in D Minor, and that the work he created needs no enhancement from Gustav Mahler or any of the other musicians who followed in his shadow."

10. Andrew Ferguson in the Weekly Standard has an amusing review of Alan Greenspan's new book: "Alan Shrugged." ("Ayn," Alan would say, overcome by some Randian insight, "upon reading this, one tends to feel exhilarated!")

11. Columbia's newest friend, Mahmoud Ahmadinejad, has another insight: Move the damn Jews to Alaska. Seriously. (Via HotAir) He must have been reading the latest dreck from a Jewish writer suffering from Weltschmerz. Can you imagine the Jews in Alaska? All the Jewish geezers would sit around all afternoon saying things like this: "Oy, it's so cold here." "Moses got the desert, but we're stuck in this icebox."

12. And you just can't miss this last one, but don't listen to it at work, unless you can close a door behind you: Don't try that satire s--- in f---in' New Yawk. (Bad language alert.)

Posted by

Attila

at

6:01 PM

|

![]()

Labels:

bad words,

Christian philosemitism,

classical music,

economics,

food,

Iran,

Islam,

left-wing anti-Americanism,

love,

mortgage,

plastic surgery,

real estate,

science

September 25, 2007

Visitor of the day -- 9/25

This visitor seems a little unclear on the concept.

August 15, 2007

Beating the scalper?

This weekend, through yesterday, I was visiting the old homestead in the New York area. I took my mother and my kids to see the Mets on Sunday. My sister and two of her kids joined us. Even though my nephew has been going to see the Mets since the 1980s, he had never seen them win a game in person. I didn't discover this fact until too late, or else I would have told him not to come. Fortunately, we ended his losing streak at approximately 18, when the Mets beat the Marlins, 10-4.

On Monday night, I was going to take my own kids to Yankee Stadium for the game against the Orioles. I'd bought some $17 upper-level seats at stubhub.com, but at almost the last minute, two of my kids couldn't come. I decided I'd just go with my younger son and see if I could unload the two extra tickets with a scalper for whatever I could get.

We drove down the Major Deegan, but a rush-hour accident caused us bumper-to-bumper traffic for miles. We didn't worry about getting to the game on time, but I realized that once the game started, my plan for selling my extra tickets would go up in smoke. Not a really big deal, but I still hoped I could manage it.

I didn't exactly know where I was going, and I ended up parking in a lot nearly a half mile east of the stadium on 161st Street. It was about 5 minutes after the game had begun, and my son and I walked quickly toward the stadium. About a block before we got there, someone called out, "You need any tickets?" I ignored him. He was persistent. "I said, 'You need any tickets?'" I turned and told the man, "I have a couple of extras. You want them?" "What ya got?" I showed him. "How much will you give me for 'em?" I asked. He replied, "Ten each" and handed me a $20 bill.

At this point, after the game had begun, I figured it was free money and didn't try to haggle. I pocketed the bill, and we went into the stadium.

But now, my competitive side kicked in. I started paying attention not to the game but to whether anyone was coming in to sit in our extra seats. Because I really wanted to beat that scalper.

No one ever did.

I figured out early on, of course, that he might have sold the tickets to someone who used them to get in the stadium but sat in better seats elsewhere. But I still enjoyed the thought that I'd gotten the better of the scalper.

What happened in the game? You really care? I told my son it was a lot like a Harlem Globetrotters game, in which the opposition Generals play tough, make a good showing, and always lose in the end to the Globetrotters. Same with the Orioles, who at least made it exciting in the 9th inning, when they tied it at 6-6, with first one runner thrown out at the plate and then the second runner scoring by a hair on the next play. (Poor Chad Bradford, a former Met, gave up the game-winning run in the bottom of the 9th on a pathetic but perfectly placed infield hit by Derek Jeter.)

Bonus: Since I've mentioned the Globetrotters, you'll be interested to know that you can hear their theme song, the Brother Bones whistled version of Sweet Georgia Brown, at this link (in mp3 format) hosted by the U.S. Patent and Trademark Office.

July 24, 2007

Look for the union label

In the area of Washington where I work, there's a fair amount of construction going on. And with the construction comes a noisy picket line protesting low wages to carpenters. On various days, I've seen the same picket at different sites. I couldn't tell whether the picketers were the same every day, but I always wondered about them. They seemed like a ragtag bunch and didn't look the least bit like carpenters to me.

Busted!

And front page, baby! Great headline, to boot: "Outsourcing the Picket Line / Carpenters Union Hires Homeless to Stage Protests"

(Maryland Conservatarian's take is here.)

May 09, 2007

Maryland repeals the law of supply and demand

If economics is the dismal science, why not spice it up a little bit?

Look, economics offers up a lot of totally stupid laws. So if you're a legislature, whose very function is to pass laws, why not substitute your own better laws for those stupid economic laws?

One of the absolutely stupidest economics laws ever invented is the law of supply and demand. I mean, why should one necessarily affect the other? Why can't we just solve social problems without worrying that our solutions are going to affect human behavior?

And, of course, by "we" I mean the state legislature in Maryland, which has passed a law, just signed by Governor O'Malley, that would require contractors dealing with the state to pay a "living wage."

Maryland became the first state in the nation yesterday to require government contractors to pay their employees significantly more than the minimum wage under legislation signed into law by Gov. Martin O'Malley (D).Who could possibly object to a law called "living wage"? It gives contractor employees an 84% increase in minimum pay, after all, and raises the comparative wages that unions in Maryland will use to negotiate their own. Presto! Money grows on trees.

The "living wage" measure, which the General Assembly passed last month, will require contractors working in the Washington-Baltimore corridor to pay $11.30 an hour. For those in more rural counties, the minimum will be $8.50. The state's minimum wage is $6.15.

Now, if you analyzed this "living wage" law under the dismal economic law of supply and demand, you'd reach the idiotic conclusion that state contractors would hire fewer employees and fire some of the ones they already had. You'd reach the even more ridiculous conclusion that they would charge the state more, or vote with their feet and take their business elsewhere.

Which is why our legislature felt the need to repeal the law of supply and demand. So now, contractors will hire the same number of employees and simply pay them higher wages, and they won't charge the state any more to perform the same services.

And if they do, the legislature will simply pass another law, prohibiting state contractors from laying off any of their workers and requiring them to continue providing services at the same rate as before.

Which is really a good thing. You can't let a little economics stand in the way of bettering the lives of our wage slaves.

Bonus: The same article reports that the Governor has also signed a bill repealing economics at the University of Maryland:

Despite a looming $1.5 billion budget deficit, O'Malley has pledged to try to continue holding the line on tuition at University of Maryland campuses. Annual tuition for in-state undergraduates at the system's flagship campus in College Park will remain at $6,566 this fall.I guess that if the economics department at College Park isn't going to be out on the street, it'll have to start teaching wizardry instead.

Posted by

Attila

at

9:16 PM

|

![]()

Labels:

economics,

Gov. OMalley,

Maryland

February 06, 2007

Mortgage scam, or not?

A federal judge has allowed a class action suit to go forward claiming that Chevy Chase Bank violated the Truth-in-Lending Act when it entered into a mortgage agreement with a Wisconsin couple. Here's a summary of the story:

With college costs looming for their four children, Bryan and Susan Andrews were looking for a way to cut their monthly expenses.The libertarian in me says that when you borrow huge sums of money with your house as security, you should pay attention to the details.

The sales pitch that came in the mail seemed perfect: A mortgage at 1.95 percent, fixed for five years.

"It sounded like a really good program," Susan Andrews recalled recently.

But after the deal closed, in 2004, the couple realized to their horror that the $191,000 loan they got from Bethesda-based Chevy Chase Bank was an adjustable-rate mortgage. The rate has climbed to 8.3 percent and, because of the way the mortgage is structured, the couple now owe more than they did when they signed for the loan.

But I've heard enough outrageously misleading radio ads for mortgage lenders that I really can understand how someone could get snookered. Here's what allegedly happened in this case:

At the core of the dispute are some words that appeared on the top right corner of a document the lender must provide under the Truth in Lending Act. One line read: "WS Cashflow 5-year fixed," and the line under it said "Note Interest Rate: 1.950%."And I can't feel too sorry for lenders who use one-month teaser rates, or set up loans where the monthly payments don't even cover the interest, so that the principle of the loan actually increases -- unless they grab the borrowers by the lapels and shake them, saying, "Do you understand what this means?"

The Andrewses said those words led them to believe the loan was a fixed-rate mortgage for five years, at 1.95 percent interest, and that they were reassured of its meaning by the broker at First Mortgage who handled the loan on behalf of Chevy Chase. In fact, the 1.95 percent offer was a teaser rate that lasted one month, and the interest charged on the loan started rising the next month. And the "fixed" feature had nothing to do with the interest rate. Rather, it meant the lowest possible payment stayed the same -- $701 a month -- over five years, although the interest rate rose, with the additional expense deferred to the end of the loan.

"This statement was confusing because although it is true that the payments on the loans were fixed for five years, the interest rate was not," the judge wrote.

So while I'm an economic libertarian in many ways, I don't think we have to let lenders play three-card monte with the borrowers. (Go ahead, kick me out of the club.)